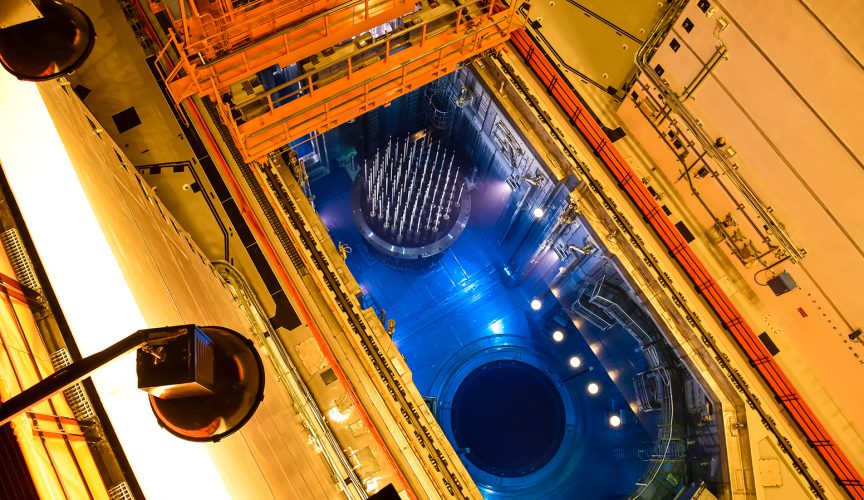

Leaked files in the Panama Papers reveal Ho’s business interest in the energy sector

Former Hong Kong minister Patrick Ho Chi-ping, who was charged in the US with bribing top African officials on behalf of a Chinese energy conglomerate, founded an obscure Hong Kong company with mainland energy investors through an offshore entity, FactWire can reveal.

Files leaked in the Panama Papers also show that he had repeatedly ignored requests by his offshore law firm to declare the vehicle’s funding sources.

Ho was arrested in New York last November for allegedly operating a ‘multi-year, multibillion-dollar’ bribing scheme to secure oil rights in Chad and Uganda for CEFC China Energy, which funded the think tank China Energy Fund Committee he headed.

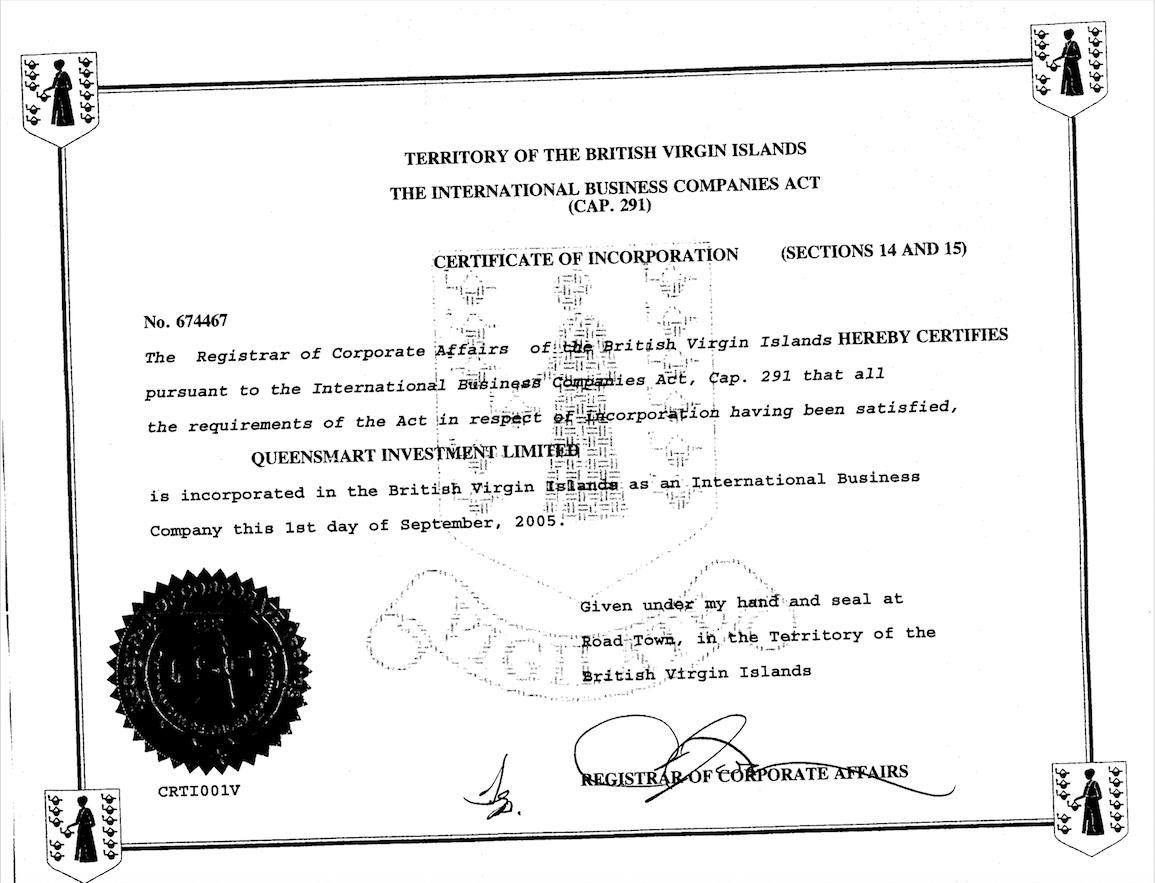

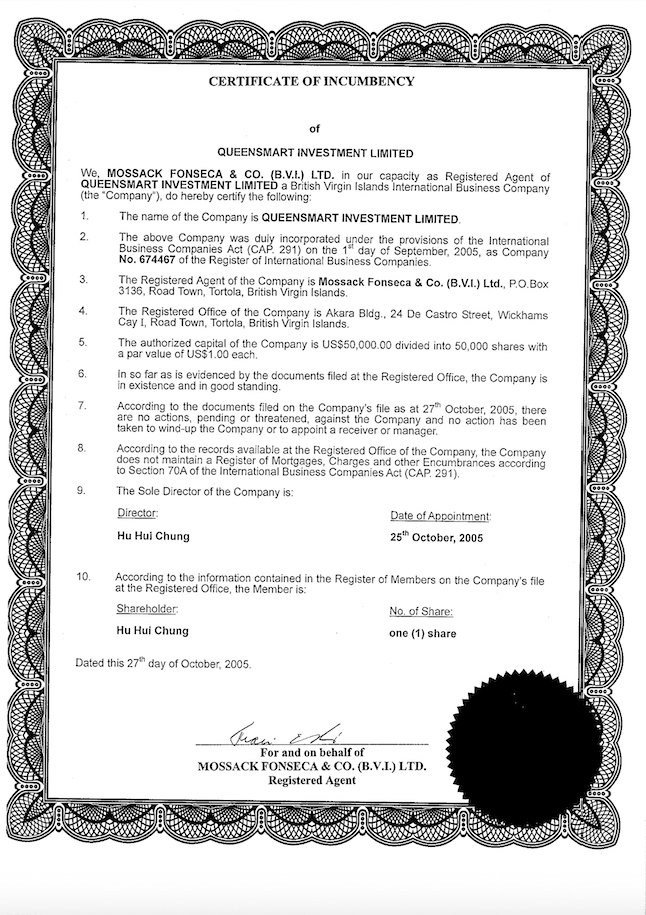

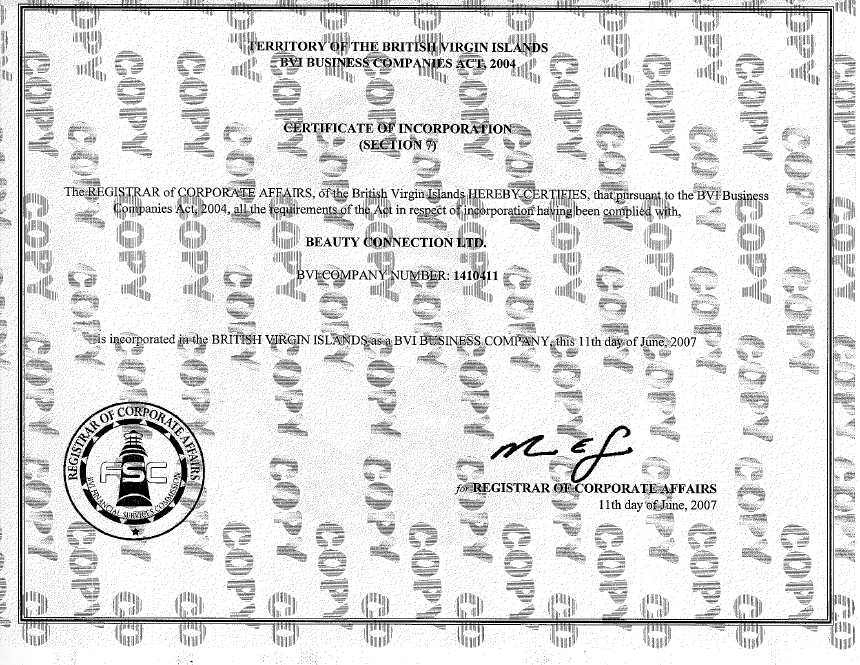

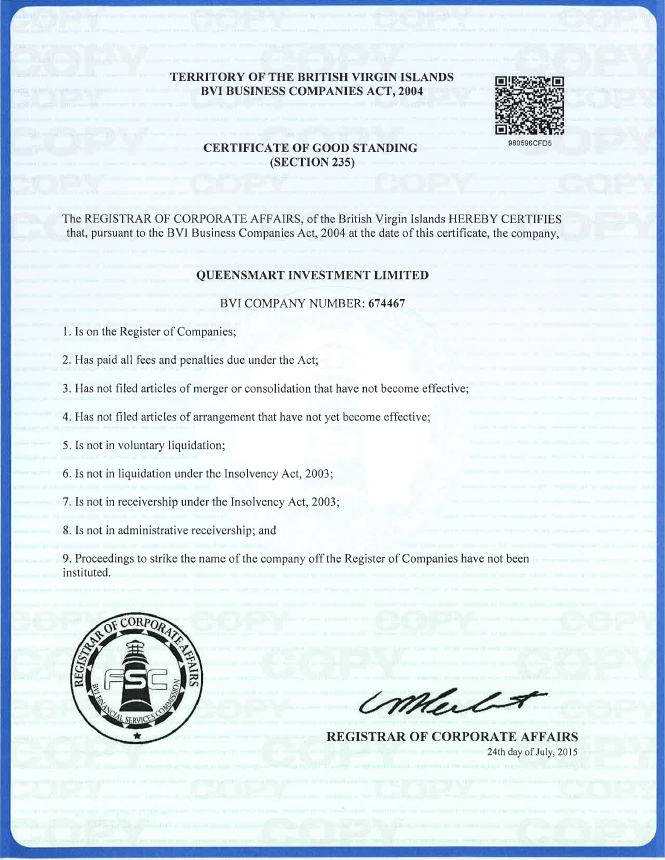

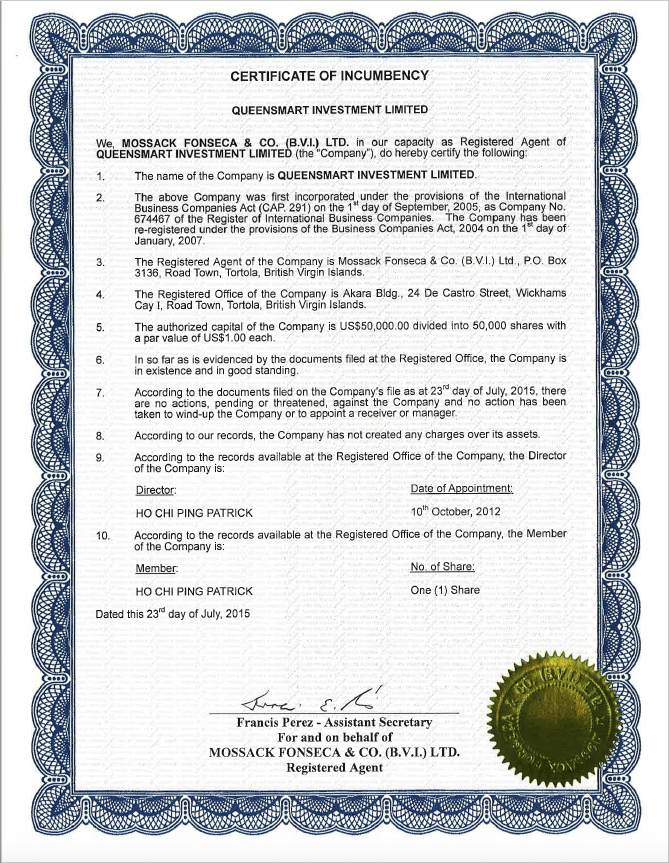

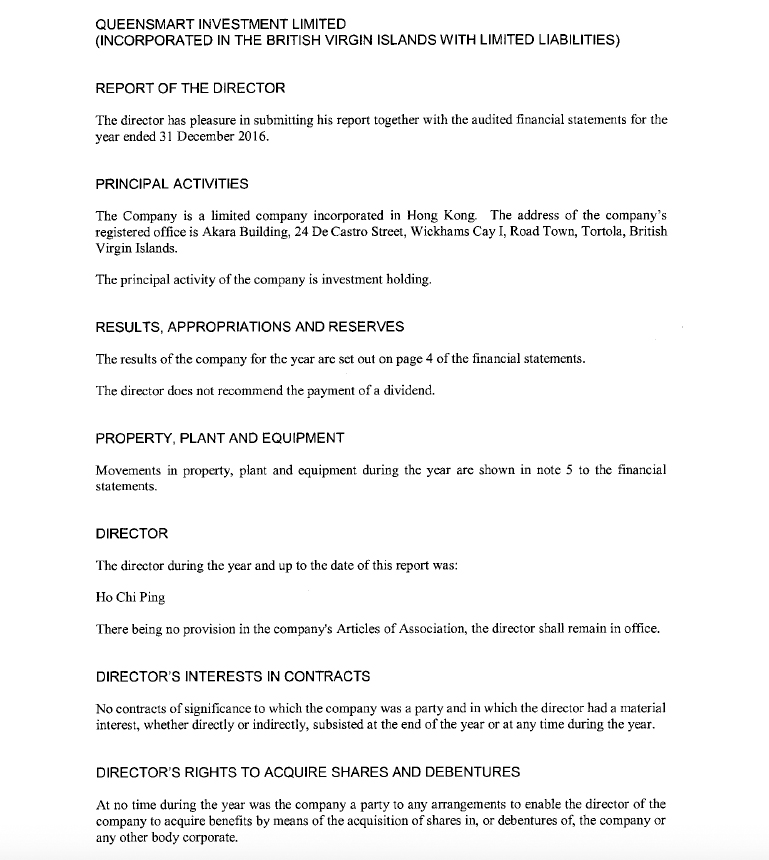

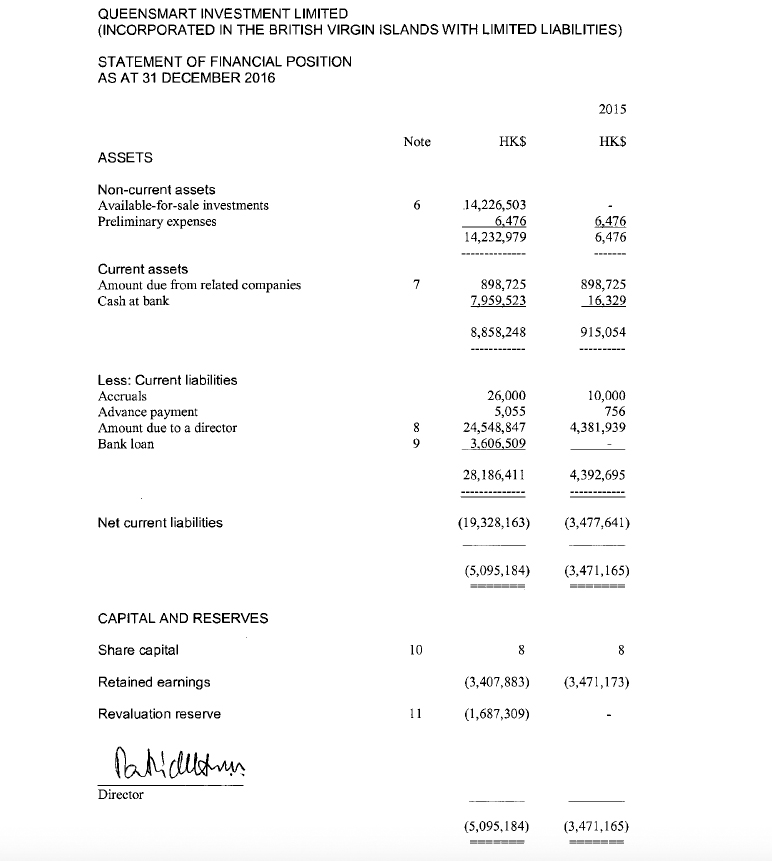

It emerges that Ho, who served as Hong Kong’s home affairs secretary between 2002 and 2007, has for years controlled at least two companies in the British Virgin Islands (BVI), one of several tax havens that allow extraordinary levels of financial secrecy.

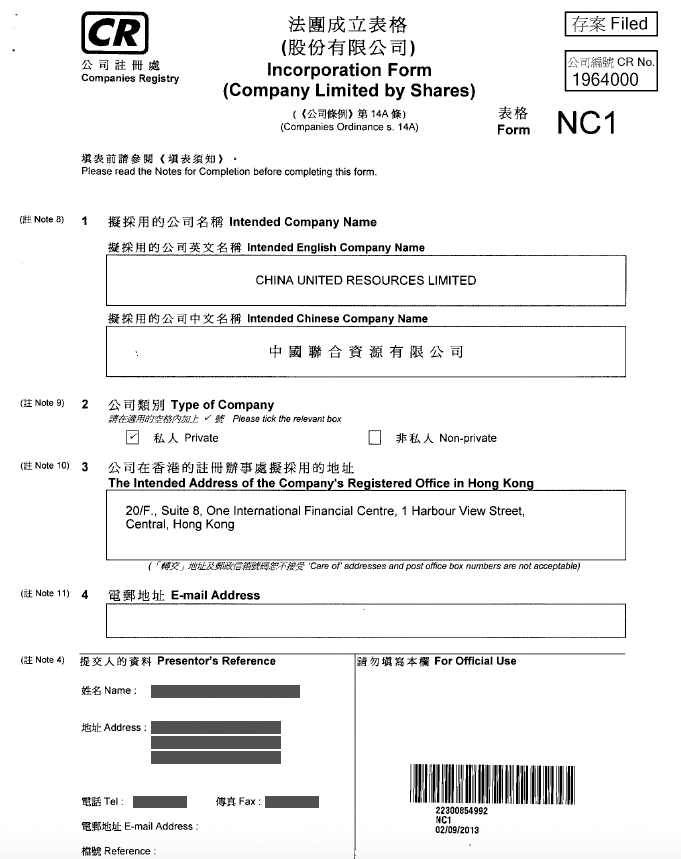

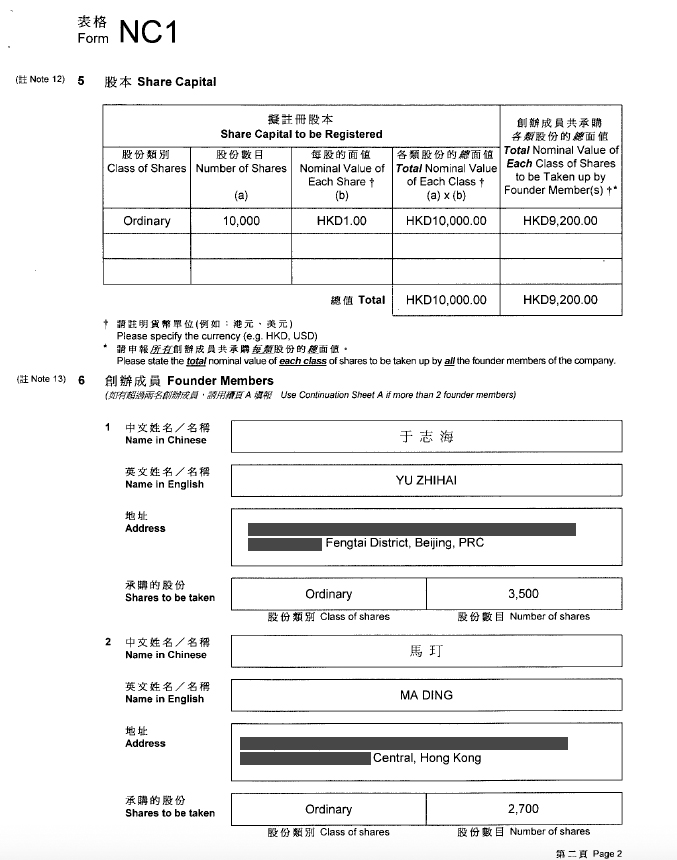

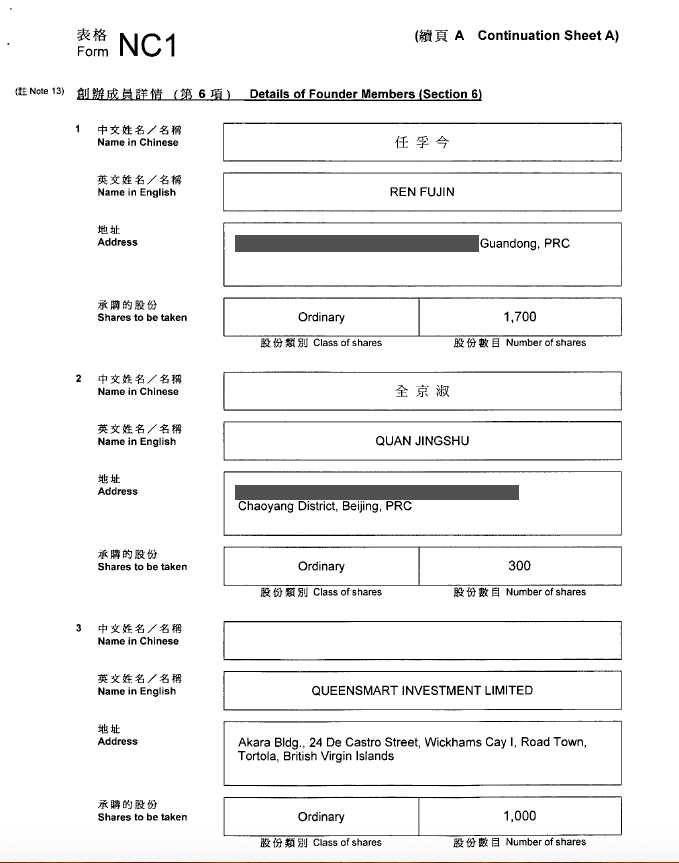

Then in September 2013 while heading the energy NGO, he partnered with a number of mainland investors to form a Hong Kong company called China United Resources, in which his BVI entity Queenmart Investment holds a 10 per cent stake.

Details of Ho’s business interests surfaced in a trove of more than 300 leaked files in the Panama Papers. The cache of documents, shared with FactWire by the International Consortium of Investigative Journalists, includes company filings, shareholder registers and email correspondence between Ho’s accounting firm and Mossack Fonseca, the now defunct Panamanian law firm at the centre of the Panama Papers scandal in 2016.

Although there is no suggestion of any wrongdoing, questions will be raised about the nature of Ho’s past business activities following his high-profile arrest for bribery and money-laundering charges.

Among the shareholders of the obscure China United Resources is energy businessman Ren Fujin, who has a 17 per cent stake in the company. Ren is the chairman of the Beijing-based AP Energy Investments. He also controls or has stakes in at least seven Chinese companies in the energy sector, including a fossil fuel exploration joint-venture with the state-owned oil giant China National Petroleum, and an energy fund that invests in overseas oil and gas projects with Shenzhen-listed Sino Geophysical.

Ren appears to have an interest in the satellite industry too. In 2014, he set up a Hong Kong company named Global Satellite Industry Investment Funds with Yu Zhihai, the largest shareholder of China United Resources and owner of an oil distribution business in the northeastern province of Heilongjiang. According to company filings, the satellite company had a paid-up capital of €15bn ($138bn) until it was dissolved late last year.

Queensmart was also listed as a director of the Hong Kong-incorporated company Galya Charitable Foundation, along with the two significant shareholders of China United Resources, Yu and Ma Ding, as well as Song Haili, who shared the same residential address in Beijing with Yu. The company was not a registered charity in Hong Kong and was also discontinued last year.

Both China United Resources and Galya were registered at the address of a serviced office at One International Financial Centre in Central. Ren and Yu, through the staff of their mainland firms, declined to answer FactWire’s questions about the two Hong Kong companies and their relationship with Ho.

American connections

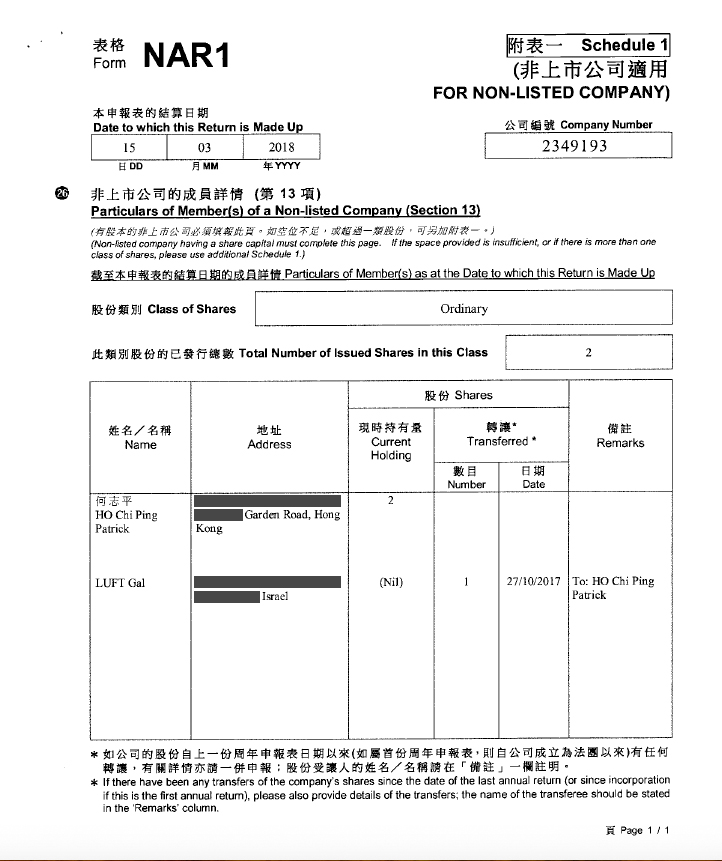

In addition to partnering with energy investors from mainland China, the former home affairs secretary had also co-owned a Hong Kong company, Holistic Solution, with Gal Luft, director of the Washington-based Institute for the Analysis of Global Security and a senior advisor to the US Energy Security Council, a cabinet-level extra-governmental advisory committee.

Luft, an advocate of China’s Belt and Road initiative, became a shareholder and director of the company in Ocotober 2016, before selling all of his stake back to Ho last October. The next month, the latter was arrested on his way to join Luft at a Belt and Road forum jointly held by their respective think tanks in the US.

It later emerged in court that CEFC had wired US$350,000 to the American NGO’s bank account in the hope of co-opting the organisation.

Offshore arrangements

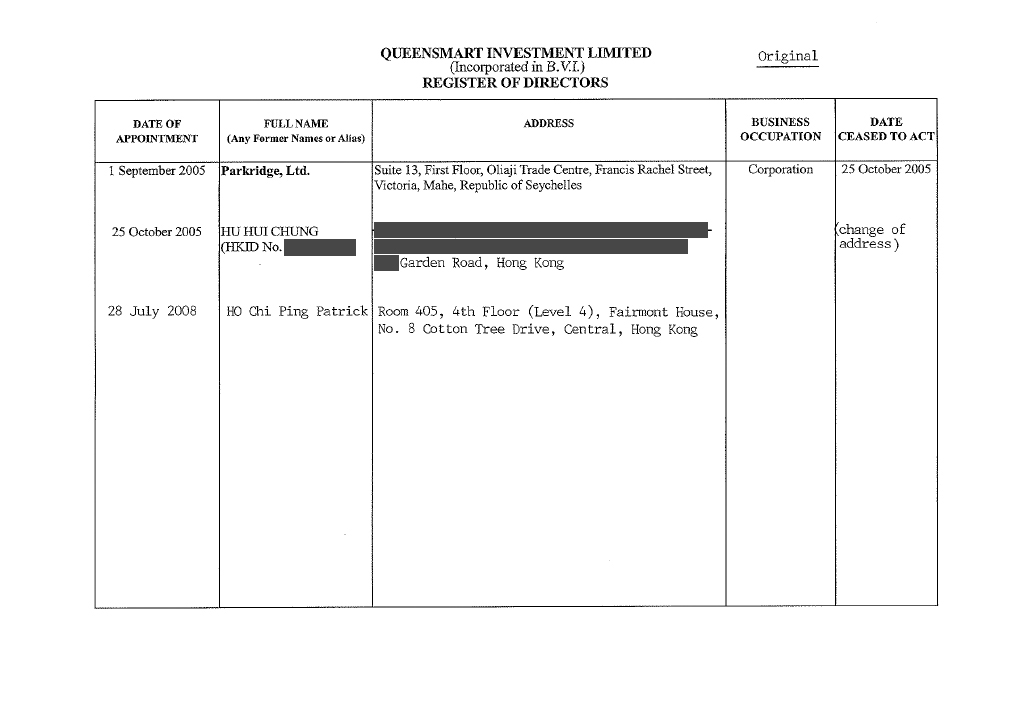

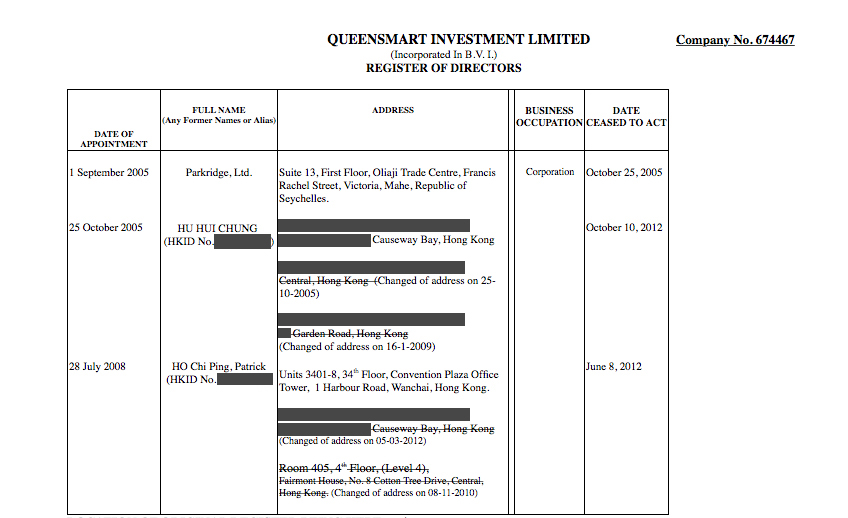

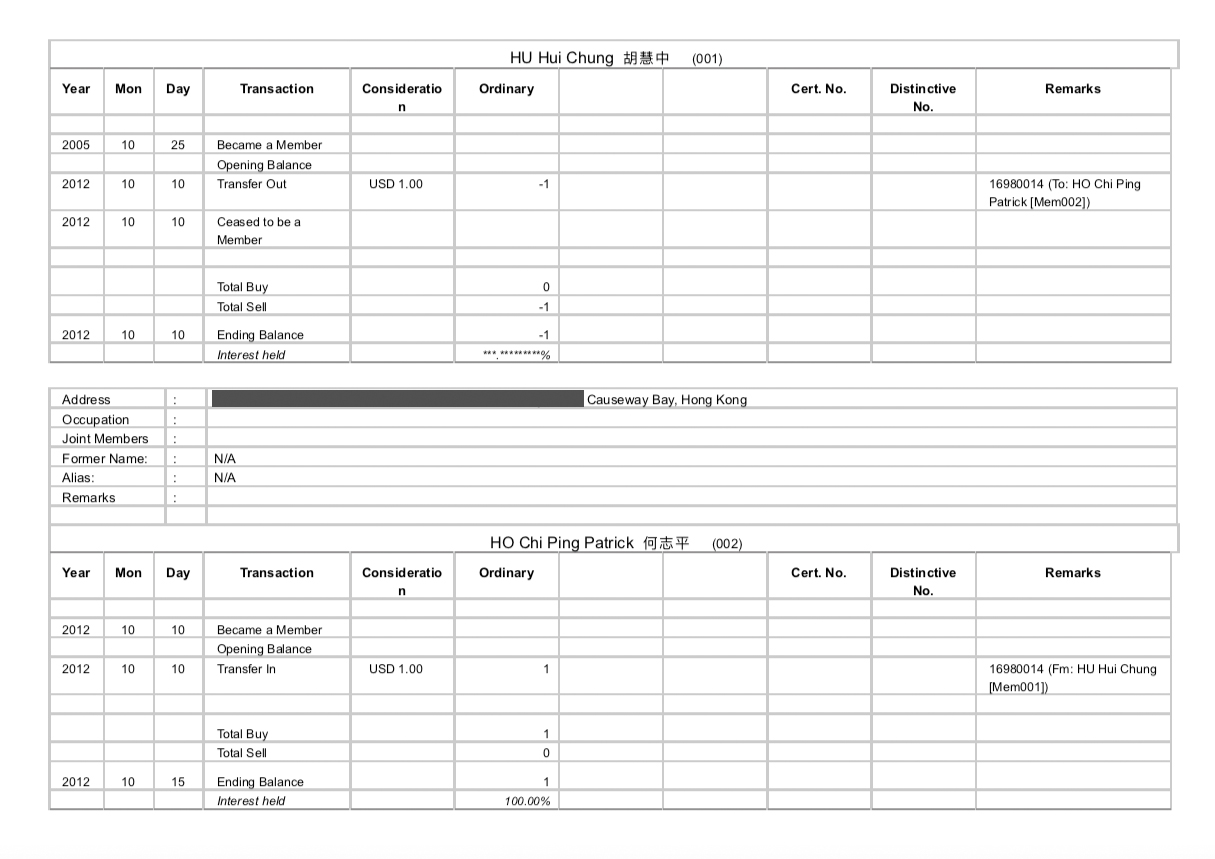

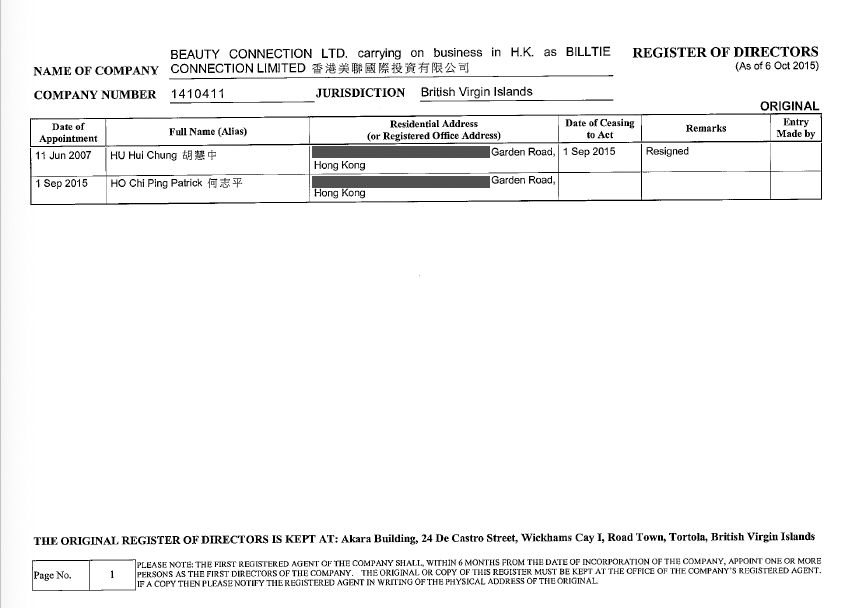

According to public records and the leaked documents, Ho’s BVI entities, Queensmart and Beauty Connection, were both originally set up by his wife, former actress Sibelle Hu, in 2005 and June 2007 respectively, when he was still in the government.

He became Queensmart’s director in 2008, and eventually in 2012, replaced his wife as its sole shareholder. He later also took control of Beauty Connection in 2015.

Both of Ho’s offshore vehicles are registered as non-Hong Kong companies at the Companies Registry, which suggests that they have established a place of business in Hong Kong. But they are not required by law to disclose their beneficial owner in corporate filings.

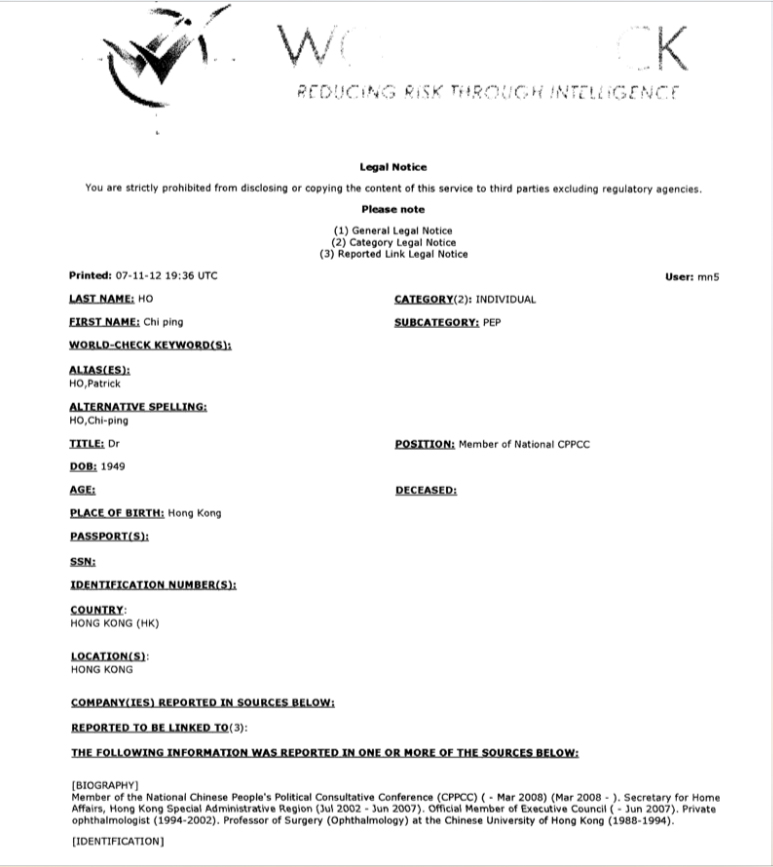

However, as a former government official and delegate to the Chinese People’s Political Consultative Conference (CPPCC), China’s top advisory body, he should be classed as a PEP – a politically exposed person who requires enhanced scrutiny and due diligence according to anti-money laundering law.

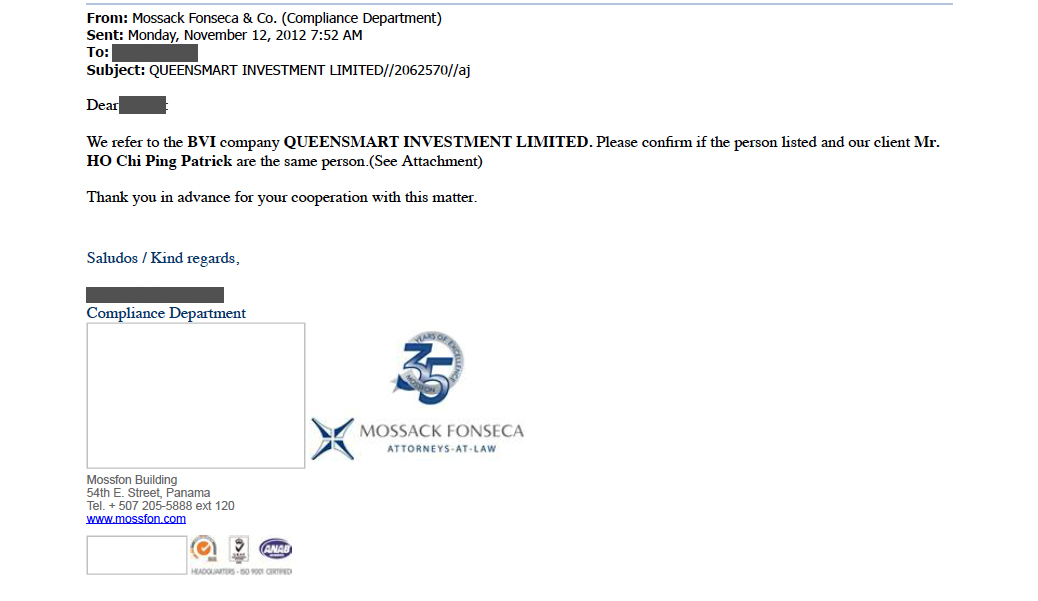

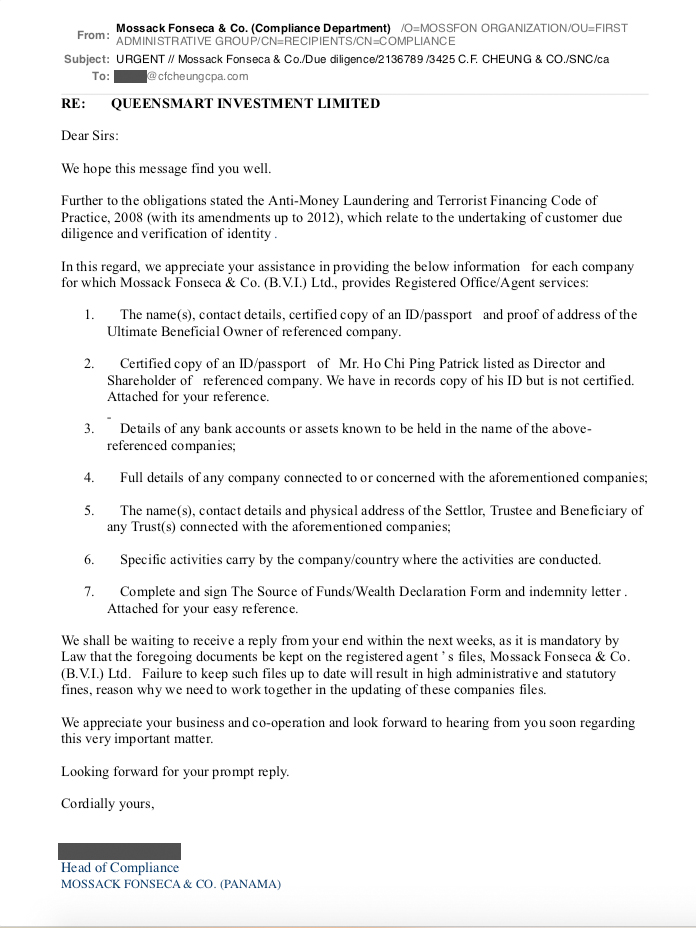

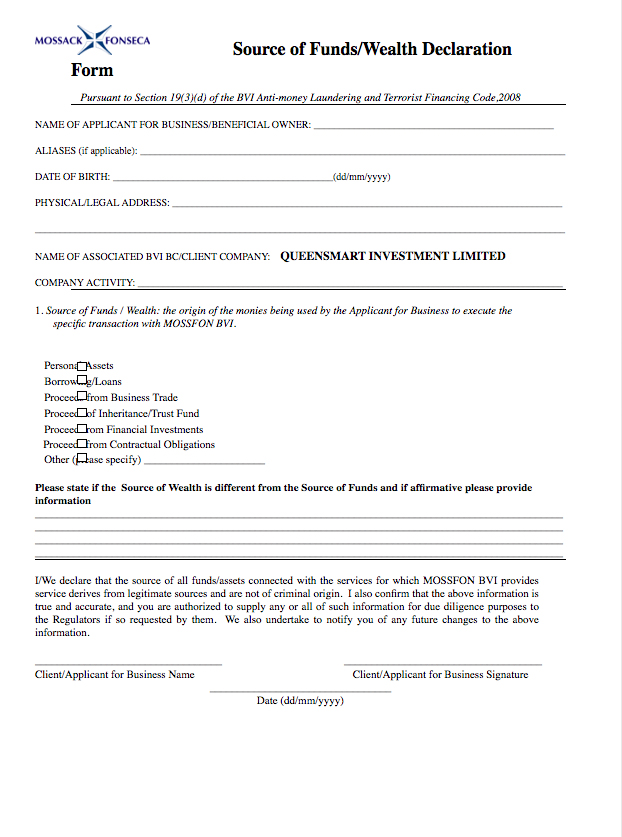

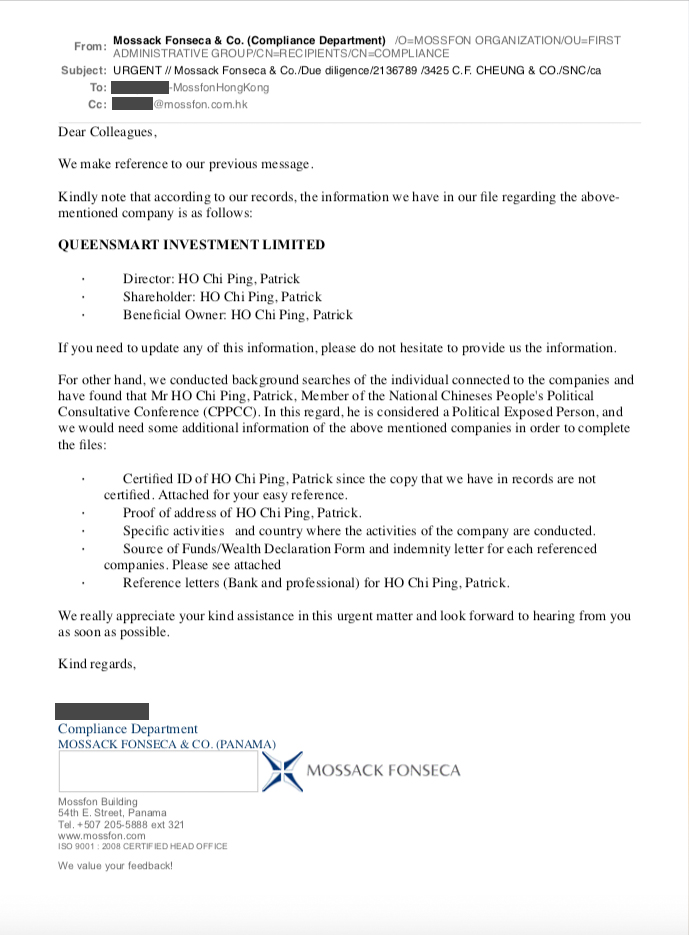

In fact, email communications show that Ho was pressed multiple times by Mossack Fonseca to disclose more information about his BVI entities, but the requests were ignored for years. The law firm continued to retain him as a client nevertheless.

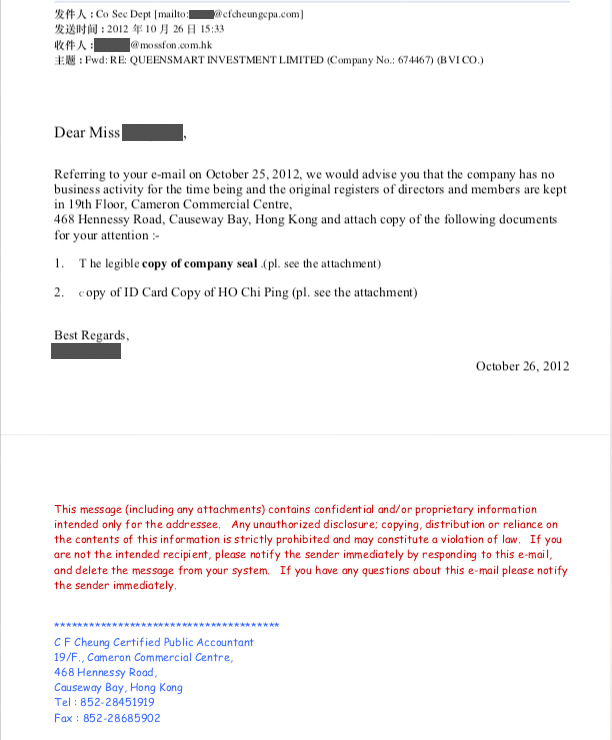

The firm’s compliance department first requested C.F. Cheung & Co., Ho’s accountant who registered the offshore companies on his behalf, to certify his identity and declare the company’s business activity in October 2012, right after he became the sole shareholder of Queensmart. At the time, C.F. Cheung replied that the company had ‘no business activity’.

The Hong Kong office of Mossack Fonseca was then asked twice by its head office to confirm Ho’s status as a politically exposed person. The request was not answered until April the next year.

Then between 2013 and 2015, around the time when Ho formed China United Resources through Queensmart, C.F. Cheung received at least three emails from the law firm requesting to disclose details including the BVI company’s finances, source of funds, its ultimate beneficial owner and business activities and connections. The request remained unanswered over the years.

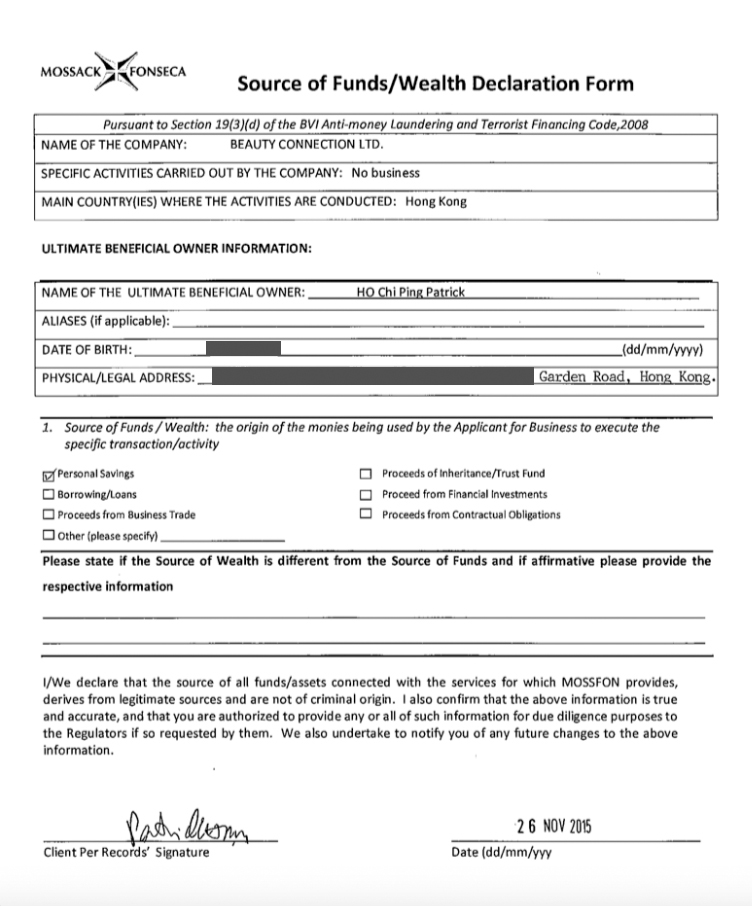

Meanwhile, C.F. Cheung did declare that Beauty Connection, Ho’s another offshore vehicle, had no business activity and was funded by personal savings when he took control of the company from his wife in 2015.

Kenneth Leung Kai-cheong, an accountancy sector lawmaker and tax advisor, said a law firm would have violated regulations if it continued to provide service to a client who repeatedly ignored disclosure requests. ‘PEPs are required to make further declarations. One would normally comply unless there was illegality in the company’s dealings, such as tax evasion,’ he said.

According to company filings submitted two months after Ho’s arrest, Queensmart’s total assets soared by more than 23 times, from around $1m between 2010 and 2015 to $23m in 2016.

Well hidden

Over the years through careful arrangements and complex structures, Ho has ensured that he would not need to declare his ownerships in the BVI entities and other Hong Kong companies as a former or incumbent government official.

For example by only becoming the director of Queensmart – originally set up by his wife when he was still in office – one year after he stepped down in 2007, he did not have to seek the approval of the Advisory Committee on Post-office Employment.

Around that time Ho also replaced Cheung Chiu-fan, the founder of his eponymous accounting firm C.F. Cheung and a long-time partner of Ho, as the director of New Silk Route, which was set up in Hong Kong in May 2008 with another company held by Cheung’s staff being its nominee shareholder.

Queensmart and New Silk Route had the same registered address at Central’s Fairmont House, where Ho reportedly had an office for promoting his patriotic ‘national education’ classes between 2008 and 2009.

Then on 8 June 2012, he again resigned from both companies, as well as another two formed in 2010 in relation to CEFC and its energy think tank, just before it was reported that Ho would be appointed to the newly created position of deputy chief secretary by the then Chief Executive Leung Chun-ying.

The controversial government restructuring plan was in the end voted down in the Legislative Council. Just a week before Leung officially announced he would shelve the plan in October 2012, Ho was reinstated as the director of Queensmart and also took control as its sole shareholder. He also became the director of two affiliates of CEFC in the next two months.

In May this year, when Ho was still in custody in the US, he made his brother the director of New Silk Route, New Silk Route Foundation and Holistic Solution. Cheung is also a director in all three.

The Panama Papers were an unprecedented leak of 11.5m files on 14,000 clients of the then world’s fourth biggest offshore law firm, Mossack Fonseca, in April 2016. The documents were obtained from an anonymous source by the German newspaper Süddeutsche Zeitung, which shared them with the International Consortium of Investigative Journalists and its media partners. The leak revealed how politicians, tycoons and celebrities hide their wealth in offshore accounts to avoid taxes. The law firm shutted down in March, two years after the scandal erupted.

It is not illegal to create or use offshore companies, but high levels of financial secrecy offered by popular jurisdictions, including the BVI, means that it is difficult to scrutinise leaders and politicians for possible corruption and conflict of interest.

Ho, who faces a total of eight corruption and money laundering charges in the US, has been in custody since he was arrested last November. His trial will begin this November. He has also lodged an appeal after being denied bail three times.

US prosecutors accuse the former Hong Kong minister of offering a total of US$2.5m in bribes to the President of Chad Idriss Deby and the Ugandan Foreign Minister Sam Kutesa on behalf of CEFC in exchange for oil rights between 2014 and 2016.

During a bail application, it emerged that CEFC, which funded Ho’s think tank, provided financial support for the formal official’s legal fees. He reported more than US$7m in assets and an annual income of over US$400,000. And according to the prosecution, through a company in the Bahamas and a trust in Jersey, Channel Islands, he also has a bank account in Switzerland that is presently worth more than US$700,000.